Earlier this yr, the U.S. Division of Vitality (DOE) introduced it might briefly pause its processing of latest purposes to export liquefied pure fuel (LNG) to nations that didn’t have a free commerce settlement with the USA. The company defined it might use the pause to refresh outdated analyses of the financial and environmental results of pure fuel exports.

However originally of July, a federal district court docket in Louisiana ordered DOE to finish the pause and restart its overview of LNG export purposes. The court docket’s ruling relied on the identical outdated reasoning that DOE had pledged to replace. If it had examined more moderen knowledge, the court docket may need come to a unique choice.

No matter what occurs within the litigation, DOE can not proceed to base its selections on outdated, inaccurate data. The company’s announcement of the pause defined:

“Because the pure fuel sector has remodeled over the previous decade, DOE should use essentially the most full, up to date, and strong evaluation potential on market, financial, nationwide safety, environmental issues, together with present approved exports in comparison with home provide, power safety, greenhouse fuel emissions together with carbon dioxide and methane, and different components.”

Company dedication to factual accuracy is much more vital at present, provided that the U.S. Supreme Court docket lately eradicated the mandate for courts to defer to affordable company interpretations of ambiguous federal statutes.

Whether or not DOE’s overview of the impression of LNG exports is carried out in a specific challenge overview or by creating a brand new coverage doc, as DOE was planning to attain by way of its pause, the up to date evaluation should happen.

The research DOE has been utilizing to guage the consequences of LNG exports had been written when the U.S. LNG export business was in its infancy. The consequences of LNG on home shoppers, native communities, and the local weather had been largely unknown.

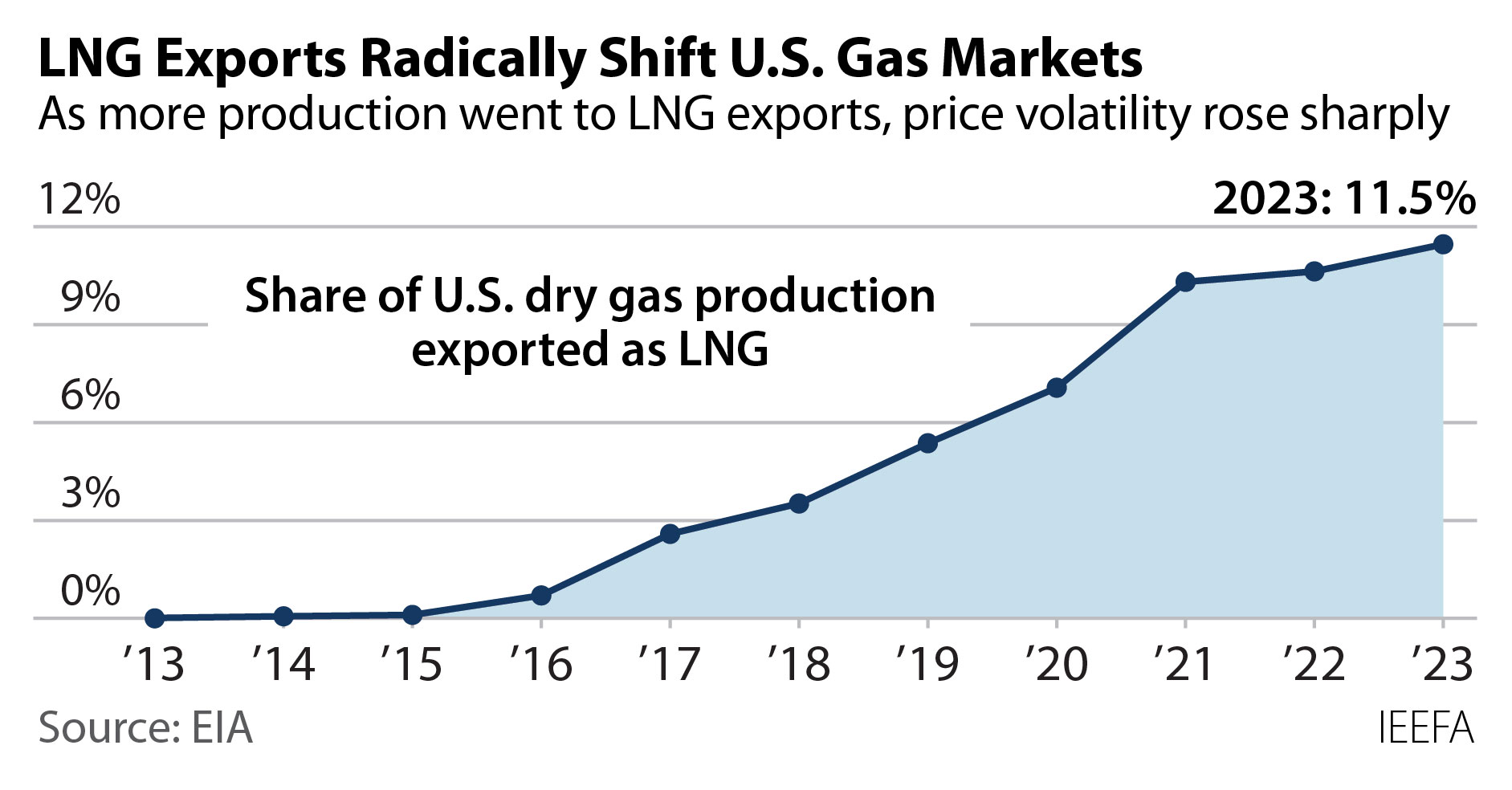

However home fuel markets have modified radically since these research had been carried out. Ranging from near-zero originally of 2016, U.S. LNG exports have skyrocketed to about 12% of complete pure fuel manufacturing within the nation.

As LNG exports have grown, shopper prices for fuel have spiked as effectively. In early 2021, winter storm Uri induced a provide shock that despatched pure fuel costs from $3 to $1200 per thousand cubic ft, as a Texas freeze additionally slashed manufacturing. In Oklahoma, clients pays a number of {dollars} extra per 30 days for at the very least twenty years to cowl the losses skilled by one of many state’s utilities. Later, the invasion of Ukraine set off a value warfare between home shoppers and fuel exporters, sending U.S. fuel costs to their highest degree in a decade.

IEEFA analyses have demonstrated that U.S. shoppers are paying extra for fuel, and the fuel is topic to a lot greater value volatility. For instance, our analysis confirmed that the Russia-induced value spikes value U.S. households and pure fuel patrons greater than $100 billion in 2021 and 2022. DOE’s outdated research by no means contemplated a value surge of that magnitude.

The outdated research on which DOE depends additionally used its Nationwide Vitality Modeling System (NEMS) to challenge outcomes for extra LNG exports. The NEMS fashions are complicated, however they haven’t any mechanism to include exogenous shocks—reminiscent of a serious winter storm or warfare—into their projections. Consequently, the modeling system is ill-suited to offer steerage on how value volatility modifications as LNG export grows.

In comparison with the seven years earlier than 2016, the benchmark Henry Hub spot value for home pure fuel has seen its volatility double. These value swings are handed alongside to shoppers—not simply of their fuel payments, but in addition in electrical energy payments, as a result of pure fuel is the most important supply of gas within the electrical energy technology energy stack. Gasoline volatility has translated into greater costs for shoppers that don’t go away shortly when volatility subsides.

Volatility may get extra extreme as LNG exports develop.

With 5 main LNG export tasks already beneath building, and fully unaffected by DOE’s pause, the U.S. will see export volumes nearly double over the following 5 years—primarily based solely on already-permitted capability.

Lifecycle air emissions from LNG actions are additionally considerably understated in present DOE evaluation. During the last decade, leak detection applied sciences have improved, and analysis has confirmed that methane releases from all the pure fuel provide chain are far greater than beforehand thought. With out even accounting for boil-off fuel losses, LNG export terminals improve emissions by 15% in comparison with pure fuel utilization that doesn’t make use of liquefaction and regasification. Moreover, the feed fuel for LNG export terminals on the Gulf Coast is delivered from areas with greater methane emissions than the nationwide common.

Exporting LNG takes the nation additional away from its emissions targets, not nearer to them.

As U.S. exports have boomed, world markets have advanced. Europe’s demand for LNG spiked in 2021 and 2022 however has fallen since. IEEFA analysis suggests Europe, Japan and South Korea—which collectively account for greater than half of the worldwide LNG market—will see a long-term decline in demand for the gas.

In the meantime an unprecedented quantity of LNG provide is beneath building across the globe. Rising provide coupled with weak demand raises the specter of a world LNG provide glut that would render some U.S. export capability superfluous. Certainly, the DOE calculus for what’s economically within the public’s finest curiosity would change if the company thought of the potential that LNG exports may flip right into a monetary albatross.

Eight years of LNG export development within the U.S. have led to greater and extra risky utility prices for U.S. shoppers, will increase in methane emissions and questionable financial advantages. Higher scrutiny of latest tasks is warranted. Pause or no, DOE has an obligation to replace the way it analyzes the prices and penalties of the continued surge in LNG exports.