For 2 years, trucking business watchers have predicted a “massacre” the place drooping charges and rising diesel press tens of 1000’s of carriers, significantly small carriers and owner-operators, out of the market and perhaps all the way in which to complete failure.

“Charges down, gas up: Is a ‘trucking massacre’ on the way in which?” Overdrive reported again in April 2022, when diesel hit file highs that may get even greater a pair months later. A full two years later, there’s nonetheless practically 100 thousand extra carriers in enterprise with authority than there have been at the start of the pandemic, loads of trucking capability, and even some fleet executives shocked by the durability of small carriers.

For positive loads of small carriers and owner-operators have thrown in towel, succumbing to the “massacre.” Partially, trucking pundits acquired it proper. However few appear to ask a related query: How are the brokers doing? It seems owner-operators might have had just a few tips up their sleeves, and certain gave nearly as good as they acquired when negotiations acquired all the way down to the wire.

First, a recap of how the service inhabitants is faring.

Provider authorities begin to crash

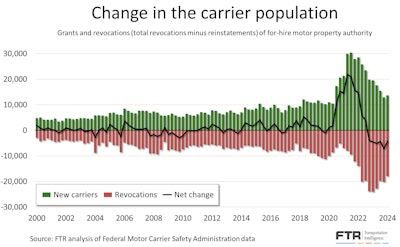

As Avery Vise, vice chairman of trucking at FTR Transportation Evaluation, lately advised Pamela De Leon for a report that first aired in Overdrive sister publication CCJ, service authority revocations peaked in late 2022 and early 2023, and stay steadily greater than earlier than the pandemic. Since then, they’ve slowed significantly from the best factors.

In some methods, although, it appears to be like like carriers who got here in by means of the gold rush of 2021 have principally caught round.

“Absolutely the variety of carriers exiting is traditionally excessive because of the unprecedented surge within the service base, particularly in 2021,” Vise advised De Leon. “Even with the big variety of service failures by means of March, the market nonetheless has 94,000 extra for-hire carriers than it did instantly earlier than the pandemic.”

Maybe these further 94,000 carriers have stored charges from coming again up, because the spot market stays full of trucking capability. Vise advised Overdrive that over a extra typical four-year interval, the market would count on so as to add about 23,400 carriers. As an alternative, we have nonetheless acquired extra 4 instances as many, all searching for a slice of the identical pie.

And the spot market story is not nearly small carriers. Even among the largest carriers have relied on spot freight as contract volumes and (extra so) charges additionally take a beating. Knight-Swift in a current earnings launch admitted they’d fairly not signal year-long contracts close to the underside of the market.

“The total truckload business continues to be difficult and oversupplied with capability,” the corporate wrote. “The early a part of the bid season led to higher than anticipated stress on freight charges as some shippers are nonetheless attempting to push charges down additional. In some circumstances, now we have misplaced contractual volumes as a result of we weren’t keen to decide to additional concessions on what we view as unsustainable contractual charges. This resulted in additional of our capability being allotted to the spot market.”

Since some indicators that the market may be turning constructive for some spot market carriers in January, each spot and contract charges for vans have fallen additional again, the unfold between the averages widening, in keeping with DAT’s Trendlines evaluation.DAT Trendlines

Since some indicators that the market may be turning constructive for some spot market carriers in January, each spot and contract charges for vans have fallen additional again, the unfold between the averages widening, in keeping with DAT’s Trendlines evaluation.DAT Trendlines

Principally, truckers are getting hammered from all angles and in all segments. Extra competitors from fellow small carriers, extra competitors from larger carriers chased out of the contract market, and extra competitors for shippers with brokers, who’re seeing revenues and margins shrink proper alongside carriers.

ATBS’ evaluation of owner-operator financials, offered on the Mid-America Trucking Present in a joint session with Overdrive, demonstrated that small carriers, in lots of circumstances, merely outran the hammering. Proprietor purchasers of ATBS ran on common 6,337 extra miles in 2023 to maintain up the numbers. Income for owner-operators was down a median of two.6%, or $4,796, to $176,817. Web earnings was down 2.1%, or $1,331, to $62,932.

They completed all this regardless of charges falling 9.4%.

Now, lastly, there’s some signal that the tide in the end has began to show.

“If you happen to evaluate the place we’re right this moment to February 2020, we’re up 38%” in service authorities, stated Vise. However “from a peak stage, the variety of approved carriers is down 8.5% since September 2022.”

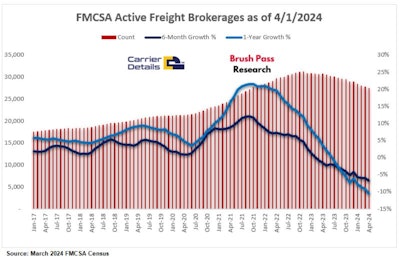

Brokers, too, are beginning to see authorities disappear at a fast clip.

Brokers crashing proper behind carriers

If the peak of the service gold rush of recent entrants occurred in September 2022, then brokers weren’t far behind, reaching their peak inhabitants of 31,225 in November 2022, in keeping with Kevin Hill of Brush Cross Analysis.

By July 2023, dealer authorities entered damaging year-over-year territory, he stated, finally falling to 27,450 by March this 12 months. That represents a 12% lower within the dealer inhabitants, and a a lot larger fall than that within the service inhabitants, which fell simply 8.5% over a barely long term.

Brokerage revenues went down 15.1% in 2023, in keeping with Hill, a lot steeper than owner-operator revenues as reported by ATBS. In accordance with Kevin Hill, dealer margins are getting squeezed, too.

“If you happen to have been making 15%” margins as a freight dealer, “it’d go all the way down to 12% a load to remain aggressive,” stated Hill. “Commissions go down, money move goes down, budgets constrict, so any buy of applied sciences are hampered. All of it places a pressure on working capital.”

Ken Adamo, freight analytics lead at DAT, in January pegged common gross margins at round 15%, and concurred that they are going down. (For an in-depth information to the place dealer margins are the best, look right here.) As of March, his analysis signifies they’ve slipped down nearer to 13 or 14%.

[Related: Broker margins, rates data, transparency: What owner-operators really think]

This can be apparent, however although they’re in the identical fundamental enterprise as carriers — trucking — brokerages occur to be fully totally different companies than trucking corporations. Truckers handle huge cell property and take care of highway hazards, legislation enforcement, enormous insurance coverage necessities and 100 different operational challenges. Brokerages handle their places of work and other people, shipper and service relationships and know-how. Even so, in keeping with this admittedly crude bit of study, carriers on the entire have discovered methods to stay it out on this market at higher charges than have brokers.

Two years into the massacre, many small trucking corporations proceed to outwit, outplay and outlast their asset-light competitors for direct clients, usually on pure elbow grease.

So to the small carriers (one truck or extra) within the viewers who’ve made it this far: What’s your secret? If you happen to’ve made main strikes or small shifts to hold on and keep worthwhile during the last two years, what did you do? Get in contact with [email protected] to share your story for an upcoming function on the habits and techniques of the indomitable house owners getting it finished day in, time out, regardless of the market situations.