Govt Abstract

Throughout the previous few years, the panorama for U.S. renewable diesel manufacturing has drastically modified, akin to the expansion of ethanol and biodiesel through the previous twenty years. Pushed by federal and state insurance policies aimed toward decreasing emissions, this dramatic U.S. renewable diesel manufacturing and capability development is inflicting important, market-altering shifts each domestically and to international feedstock commerce. Renewable diesel, like biodiesel, is produced from the identical renewable feedstocks equivalent to vegetable oils, animal fat, or used cooking oil (UCO). The distinction is that renewable diesel is produced utilizing a hydrogen remedy which makes it chemically equal to petroleum diesel and might due to this fact be blended at increased ranges and transported utilizing current pipelines.

Consequently, america is quickly increasing imports of animal fat and vegetable oils to each use as feedstocks for renewable diesel manufacturing and to backfill different feedstocks, like soybean oil, which were diverted to renewable diesel manufacturing. Domestically, U.S. soybean crush expanded to provide extra oil, pushed by excessive soybean oil costs fueling robust crush margins. Whereas home demand grew, U.S. soybean exports declined on increasing Brazilian provides and slowing development of world import demand. Moreover, U.S. soybean oil premiums rocketed to this point above world vegetable oil costs that U.S. exports plummeted, and america grew to become a internet soybean oil importer for the primary time in 2023. Greater soybean crush is driving the other for meal exports, as an abundance of soybean meal, mixed with drought in Argentina – the world’s largest soybean meal exporter – has boosted exports with the potential for continued development. Whereas many wildcards might have an effect on the U.S. biofuel, animal fat, and oilseed markets, renewable diesel manufacturing is anticipated to proceed to develop and alter feedstock markets. The speed of manufacturing development, nonetheless, will probably be extremely depending on federal and state insurance policies, availability of feedstocks, and sustained U.S soybean meal export beneficial properties.

The Renewable Diesel Manufacturing Increase

The drastic growth of renewable diesel manufacturing through the previous few years is coverage pushed. Demand for renewable diesel is propelled by the carbon-emission reductions that it supplies relative to petroleum diesel, and in contrast to biodiesel, can be utilized as an alternative choice to petroleum diesel relatively than restricted to mixing at low ranges. Petroleum diesel and renewable diesel aren’t the identical, however they’re so related and substitutable that they compete on an energy-adjusted worth (petroleum diesel has a barely increased vitality content material). The manufacturing price of renewable diesel is considerably increased, nonetheless, resulting in a sizeable premium over petroleum diesel. Thus, with out federal and state carbon-reduction insurance policies mandating minimal portions and offering tax credit, there wouldn’t be a marketplace for renewable diesel manufacturing.

From a federal standpoint, there are two principal insurance policies incentivizing the manufacturing of biomass-based diesel, which incorporates each renewable diesel and biodiesel. The primary is the Blender’s Tax Credit score, which supplies tax reduction for mixing biomass-based diesel into the U.S. diesel pool. This partially offsets the upper manufacturing price of biomass-based diesel and helps to slender the premium over petroleum diesel. The second federal coverage is the Renewable Gasoline Normal (RFS). This coverage creates a mandated minimal for biofuels, equivalent to biomass-based diesel, Sustainable Aviation Gasoline (SAF), and ethanol, that must be blended into the overall U.S. gas pool.

Whereas these federal legal guidelines are incentivizing the expansion of biofuels, the true driver for renewable diesel growth has been the California Low-Carbon Gasoline Normal (LCFS). Just like the blender’s credit score, this coverage offsets increased biomass-based diesel manufacturing prices via a carbon credit score for assembly emission targets and has pushed renewable diesel consumption in California. Since California had already reached mixing maximums for each ethanol (10 p.c of gasoline pool) and biodiesel (5 p.c of diesel pool), blenders wanted to make the most of different carbon-emission-reducing alternate options equivalent to mixing extra renewable diesel, utilizing extra SAF, or reducing the carbon emissions of manufacturing and mixing current biofuel consumption. Consequently, renewable diesel expanded because it doesn’t have a mixing ceiling like biodiesel and ethanol, and due to an inflow of personal funding to extend manufacturing capacities spurred by the long-term demand stability for biofuels created by the LCFS.

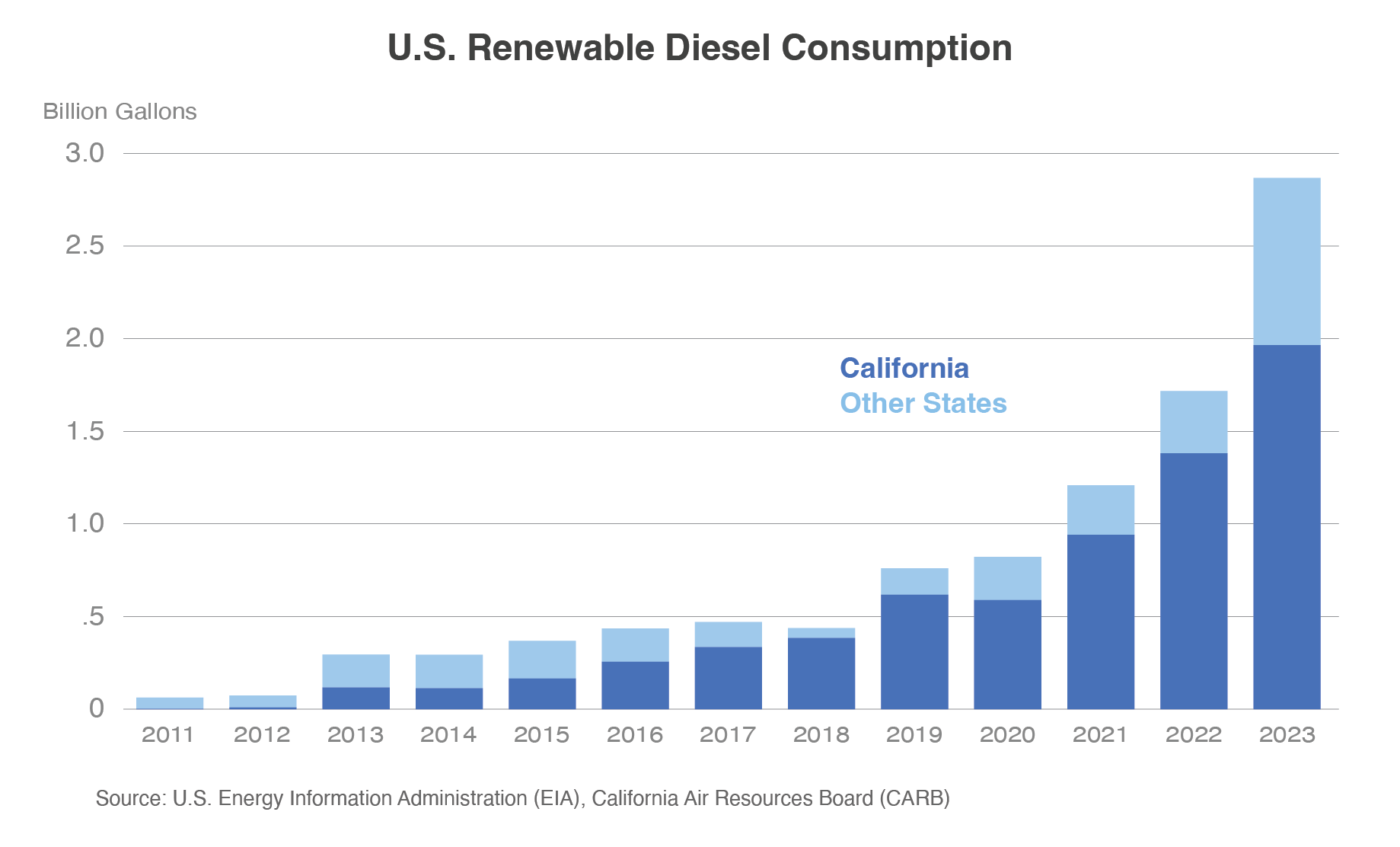

Whereas the RFS units a nationwide mandate for biofuel consumption, the LCFS created a powerful monetary incentive that pulled many of the renewable diesel quantity to the California market. Between 2020 and 2023, development in California consumption was greater than double the consumption development all through the remainder of america. Consequently, biomass-based diesel accounts for about 60 p.c of the California diesel pool whereas the remainder of america stays within the low single digits. Whereas Oregon and Washington have related state insurance policies to the LCFS, California is the largest-consuming and fastest-growing state and is accountable for driving the meteoric ramp-up of renewable diesel capability and manufacturing.

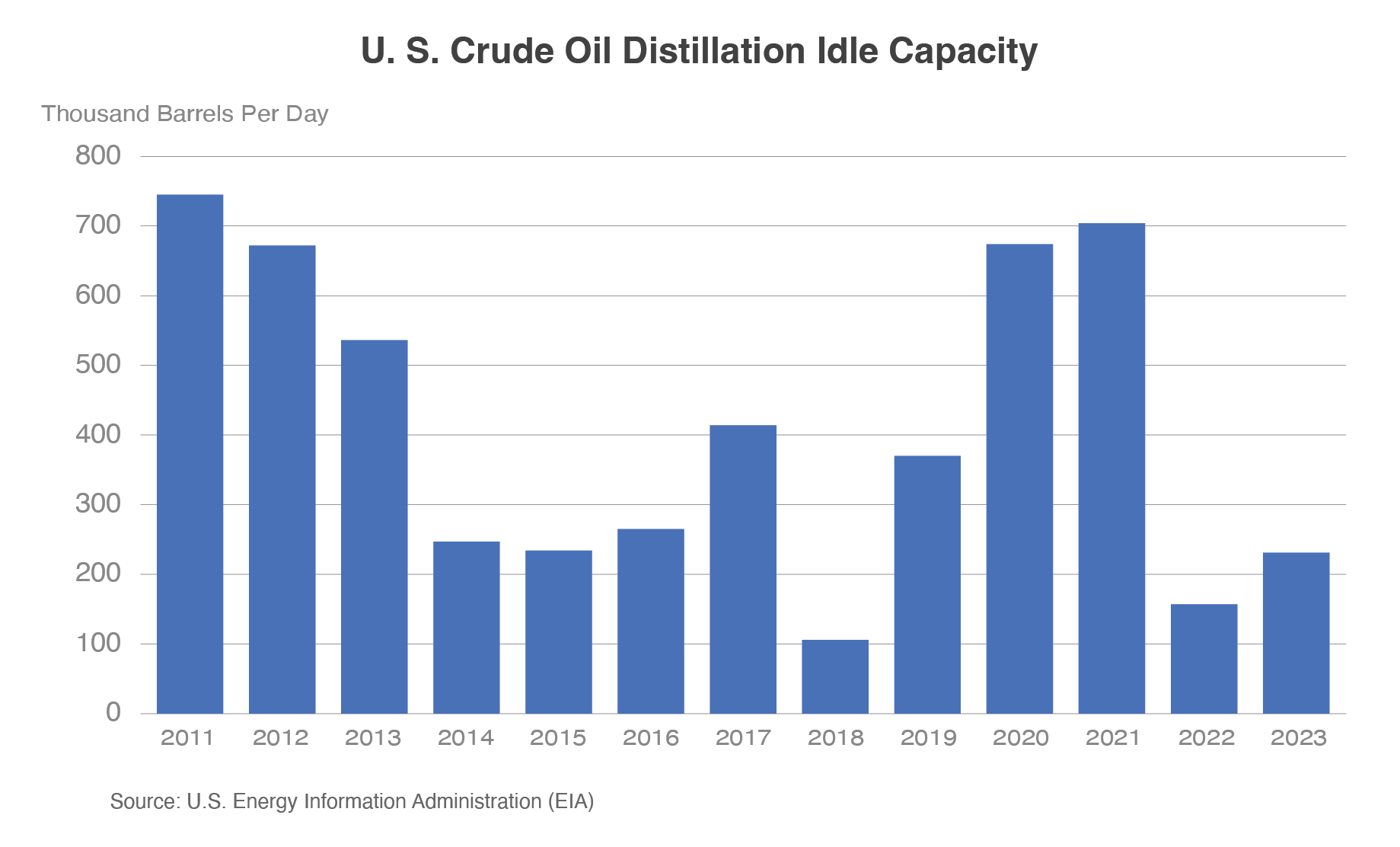

Lastly, key market elements have helped help the growth of renewable diesel manufacturing through the previous few years. First, the method and tools wanted to make renewable diesel (and SAF) is like that used to make petroleum diesel. This allowed corporations to transform half, or all, of some current refineries from producing gas from petroleum into making renewable diesel and SAF from animal fat, vegetable oils, and hydrogen. Lots of the choices and bulletins to repurpose refineries for renewable diesel got here in 2020 and 2021, when idle capability at petroleum refineries hit decade-highs as a result of COVID-19 impacting oil consumption and costs. This additionally coincided with the business’s gradual transition from crude oil petroleum corporations to vitality corporations via investments in various vitality sources. Moreover, renewable diesel was capable of develop shortly on the expense of biodiesel, as the 2 compete for a similar feedstocks. As manufacturing of renewable diesel has expanded, biodiesel has regularly trended the other way since peaking in 2018. In actual fact, U.S. renewable diesel manufacturing capability surpassed biodiesel in July 2022, which led to renewable diesel manufacturing exceeding biodiesel in 2023.

Robust U.S. Demand for Fat and Oils Results in Elevated Imports

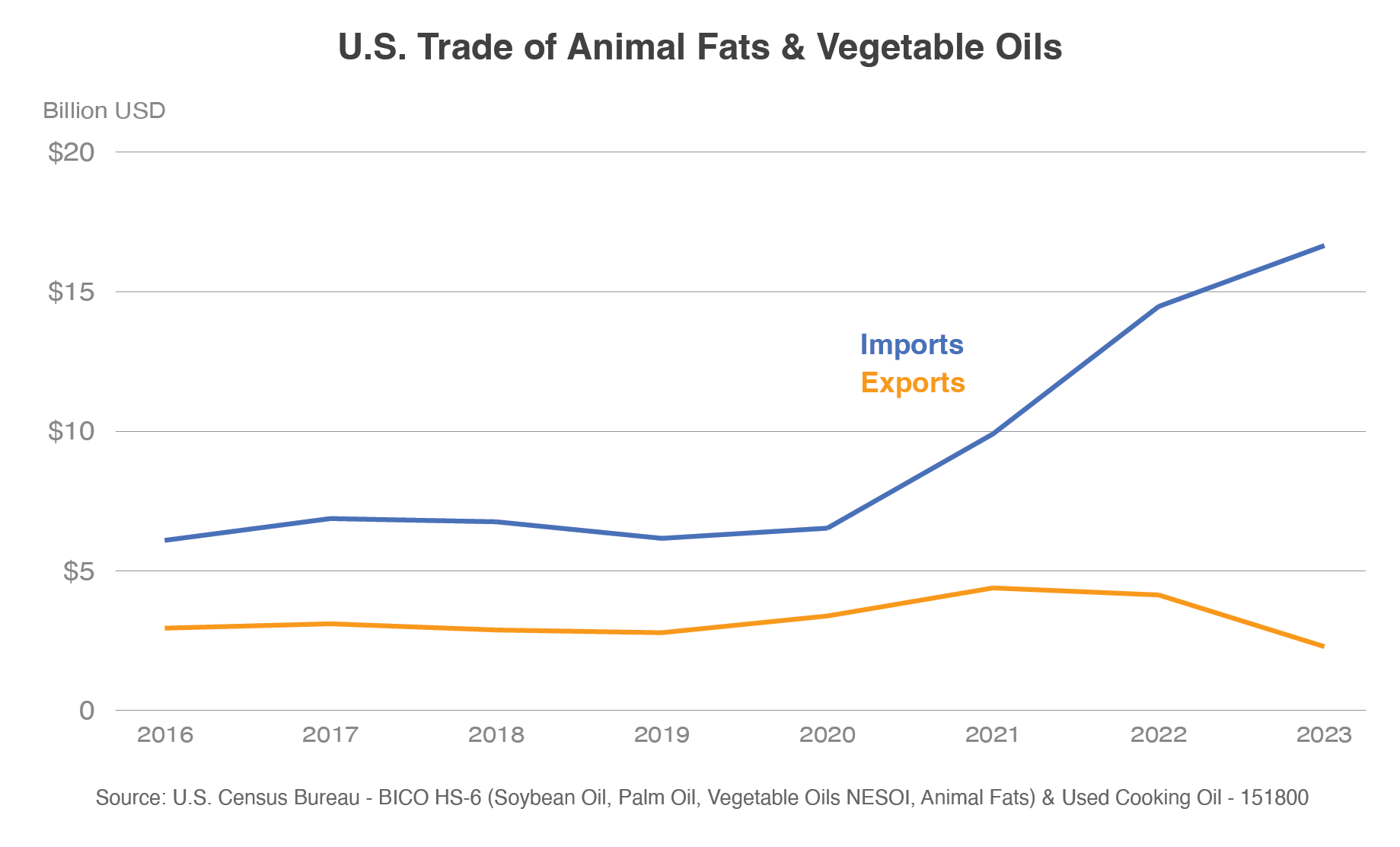

The explosion of renewable diesel capability and manufacturing has considerably bolstered U.S. demand for feedstocks equivalent to fat and oils. Consequently, U.S. imports of vegetable oils and animal fat have exploded.

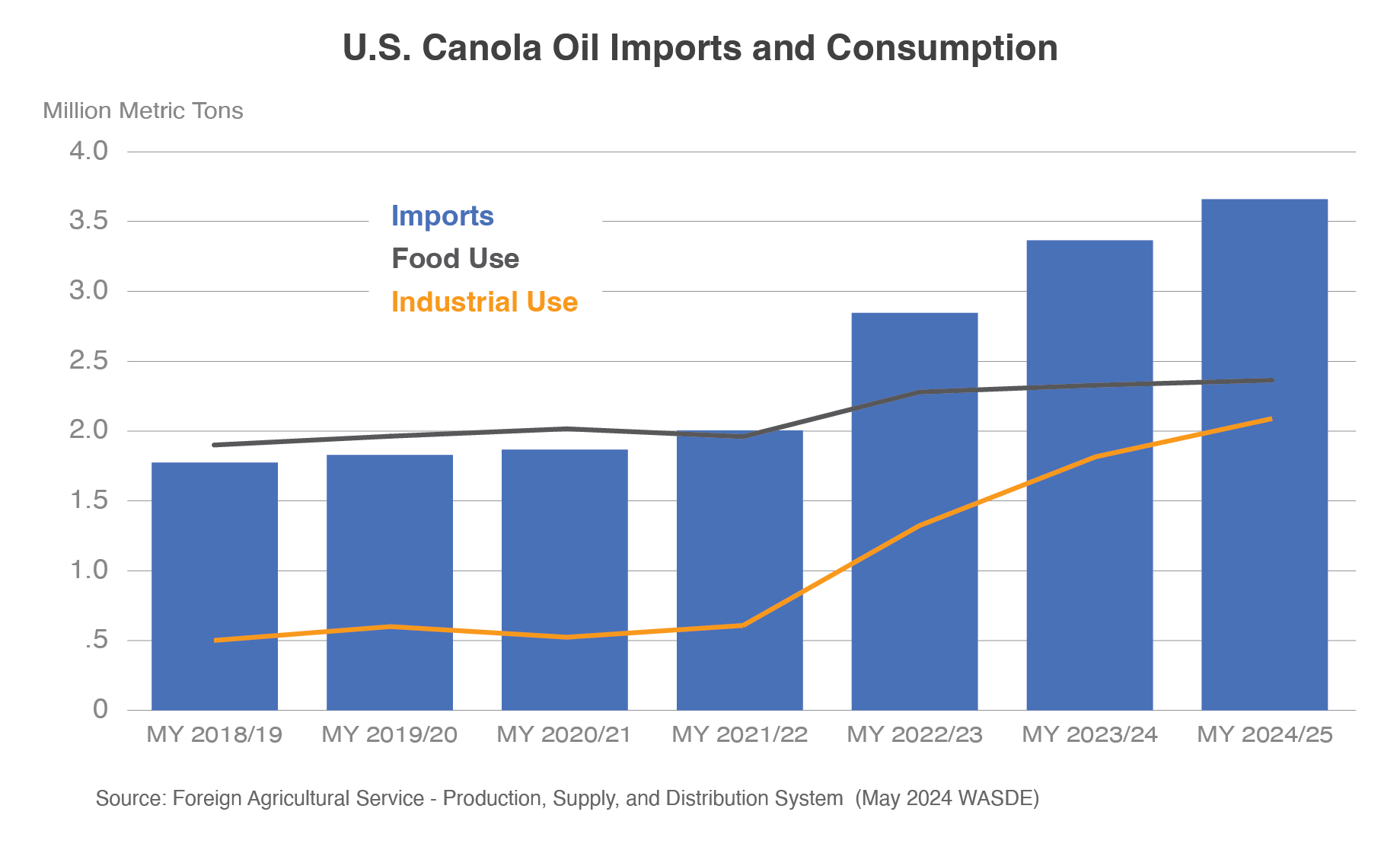

For instance, canola oil imports surged through the previous two years as a direct results of increasing renewable diesel manufacturing and coverage modifications. In December 2022, the Environmental Safety Company introduced that canola oil meets the RFS necessities for use as a feedstock for renewable diesel. Consequently, U.S. canola oil imports jumped to a document. Whereas most of this demand was for biomass-based diesel manufacturing, a number of the elevated provides had been used for meals, backfilling the displaced soybean oil that had been rerouted to provide renewable diesel. That is unlikely to be a short-term spike, as U.S canola oil imports, meals use consumption, and industrial consumption are all forecast to be data for the third consecutive yr in 2024/25. With a free commerce settlement and geographical proximity to Canada, the world’s largest canola/rapeseed oil exporter, america will proceed to have entry to ample provides. Throughout the previous few years, america has jumped from accounting for 50-60 p.c of Canada canola oil exports to 91 p.c in 2023. Moreover, canola oil provides ought to stay strong as Canada introduced plans to develop crush capacities within the subsequent a number of years.

Canola oil supplies a transparent instance of how U.S. import demand can spike as a direct results of renewable diesel growth, however this pattern shouldn’t be distinctive and relatively consultant of many different inputs. In 2022, the principle feedstocks for renewable diesel had been yellow grease, soybean oil, corn oil, tallow, and canola oil. As anticipated, the collective imports for animal fat and vegetable oils have grown drastically in alignment with the expansion of renewable diesel. In actual fact, U.S. import values of all animal fat and vegetable oils greater than doubled from 2020 to 2023. One of many main drivers was UCO imports, which greater than tripled in 2023 on increased imports from China.

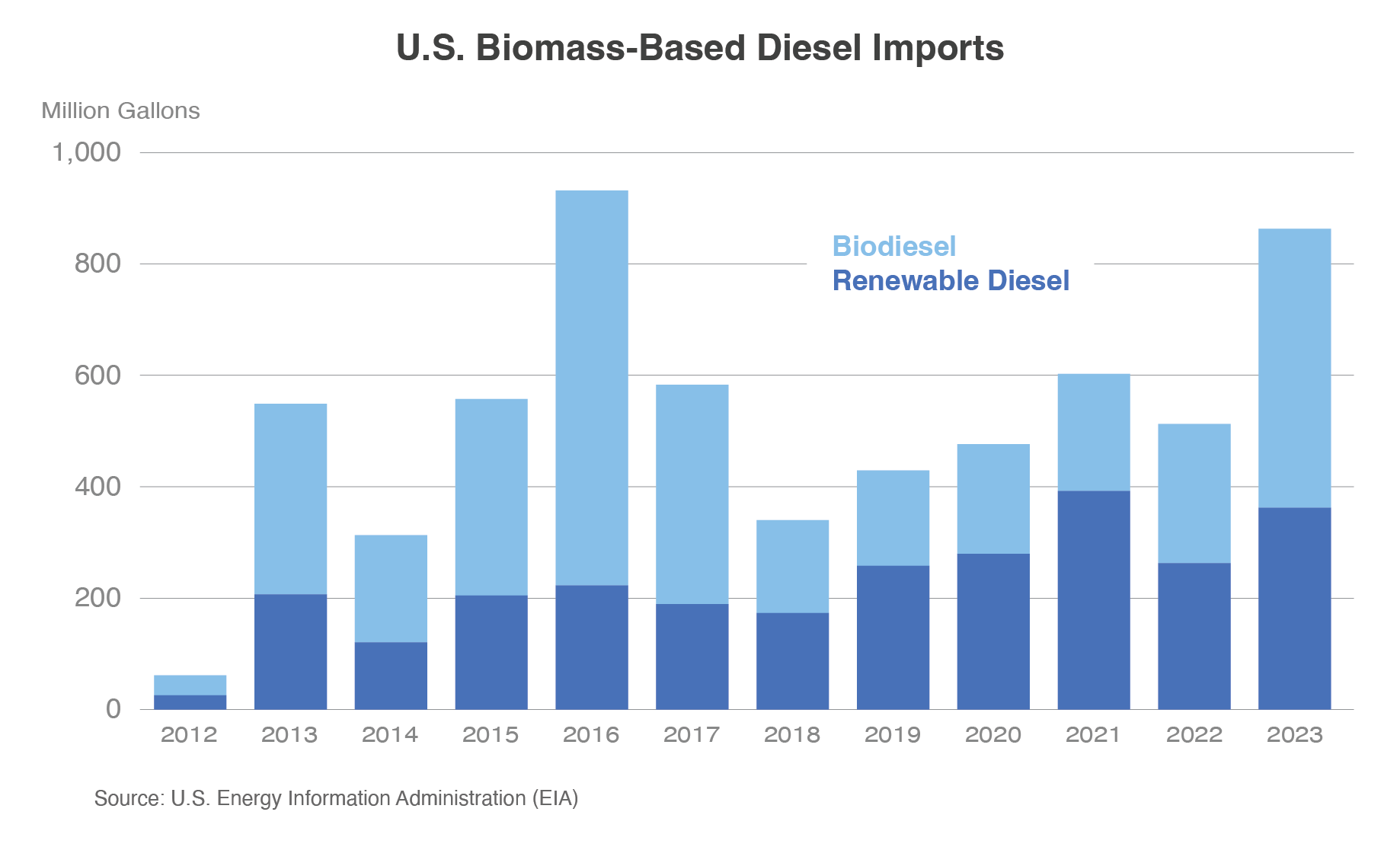

U.S. imports of animal fat and vegetable oils ought to proceed to develop in tandem with biomass-based diesel manufacturing, however it can get an extra coverage bump subsequent yr. Beginning in January 2025, the federal authorities will transition from a blender’s credit score to a producer’s credit score. Subsequently, the tax credit score will solely apply to biomass-based diesel that’s produced in america. Thus, demand for biofuel imports is anticipated to drop considerably, driving even better imports of fat and oils to U.S. refineries to provide these biofuels domestically. Throughout the previous 5 years (2019-2023), biomass-based diesel imports averaged about one-fifth of manufacturing volumes, signaling a considerable alternative for a bump in feedstock demand subsequent yr, additional boosting a commerce deficit that has been quickly increasing.

Moreover, the Producer’s Tax Credit score, coupled with the California LCFS, will heighten the demand for decrease carbon-intensity feedstocks like tallow, UCO, and corn oil. Beneath the LCFS, west-coast market demand is stronger for feedstocks that present better carbon-emission reductions than virgin vegetable oils like canola and soybean oil. These insurance policies will proceed to tug obtainable world feedstocks into the California renewable diesel market, and enhance U.S. import demand for feedstocks that make decrease carbon-intensity biofuels that generate extra credit within the California market.

Elevated Home Demand Stimulates Crush and Suppresses Soybean Oil Exports

The growth in renewable diesel manufacturing has not solely altered conventional import patterns, however U.S. agricultural export market dynamics are experiencing drastic shifts too. Firstly, U.S. soybean exports have trended downward since reaching a document in advertising yr 2020/21. Whereas U.S. soybean exports are forecast increased in 2024/25, U.S. share of world soybean commerce is anticipated to stay under the 5-year common. The biggest drive dampening U.S. soybean exports is larger competitors from Brazil, which is forecast to extend its soybean space harvested for 18 consecutive years in 2024/25. On account of an absence of storage capability, Brazil costs beans at a reduction to U.S.-origin soybeans after the South American harvest to make sure provides are cleared out earlier than subsequent yr’s crop. Growing Brazilian manufacturing means bigger provides to compete with U.S. soybean exports through the typical promoting window after the U.S. harvest.

Secondly, the decline in U.S. exports is partly as a result of lowered demand development in China. The mixture of animal illness, slowing financial development, and efforts to scale back soybean meal utilization have dampened Chinese language import development effectively under common charges through the previous twenty years. On account of slower development and elevated Brazilian competitors, america has misplaced market share in China since 2020/21. Moreover, financial points and commerce boundaries lowered import demand for U.S. soybeans in Egypt, Pakistan, and Bangladesh. Whereas a lot smaller than China, collectively these markets represented 10 p.c of U.S. soybean exports 2021/22. In 2022/23, nonetheless, U.S. soybean exports to those nations plummeted by 4.0 million tons to only a three-percent share of U.S. exports.

Renewable diesel development, nonetheless, is partially offsetting falling exports by stimulating home soybean consumption. In 2024/25, U.S. soybean crush is forecast at a document for the fourth consecutive yr. This can be a direct impact of increasing renewable diesel manufacturing as excessive home soybean oil costs have elevated crush margins. Consequently, home crush is rising and serving to to offset the shrinking U.S. share of world exports as South American provides proceed increasing.

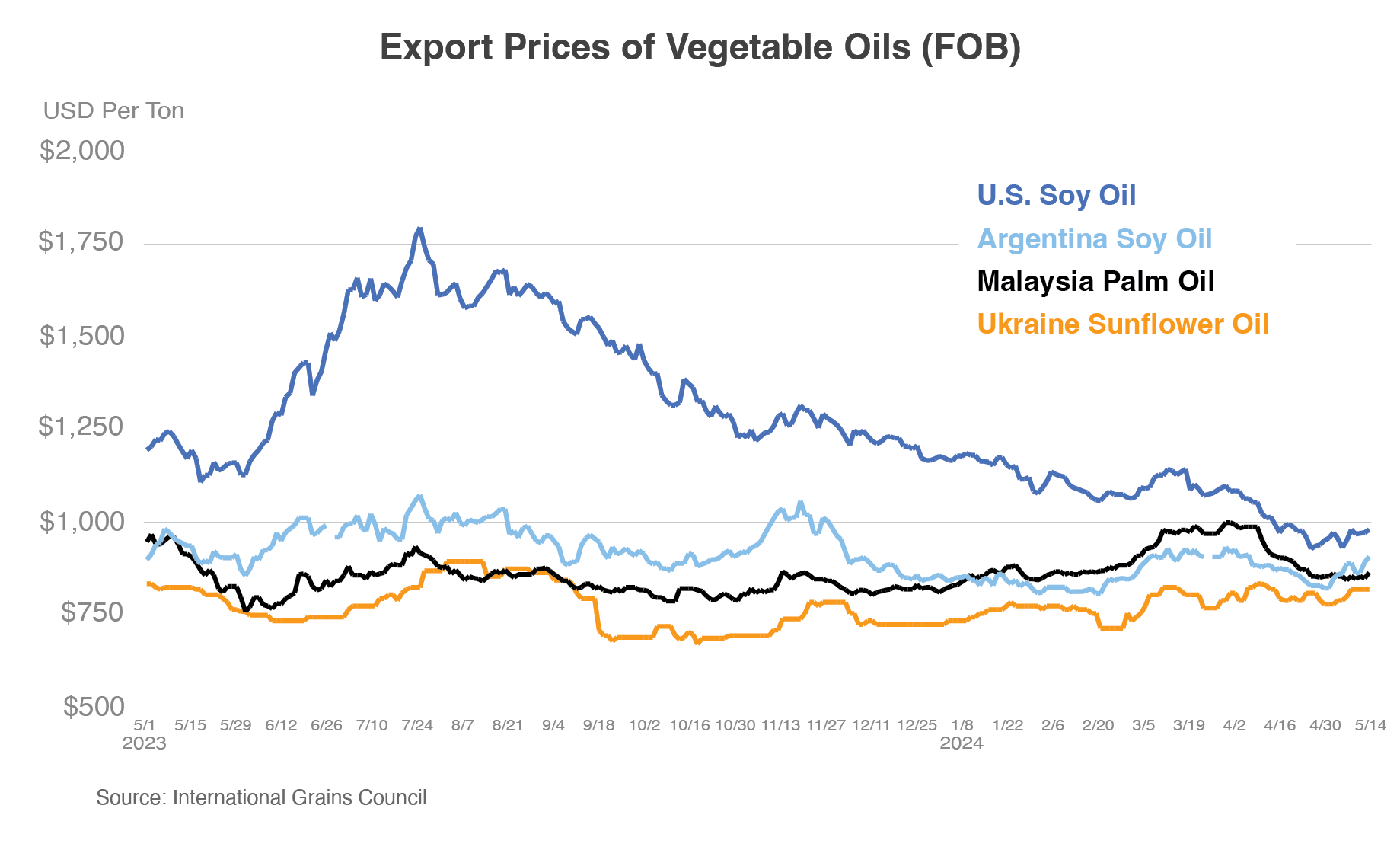

Moreover, U.S. soybean oil exports have been drastically impacted by renewable diesel growth. The primary issue being the numerous U.S. worth premium above South American-origin soybean oil, which has rendered U.S. exports uncompetitive. The sudden spike in U.S. demand for soybean oil created a shortage within the home market, pushing the worth U.S. patrons had been prepared to pay effectively above opponents’ costs in South America. After the preliminary renewable diesel growth in 2021, U.S. soybean oil exports fell by 80 p.c and haven’t recovered. The drop in exports was so important that america grew to become a internet importer of soybean oil (tonnage-basis) in 2023 for the primary time ever. In actual fact, the worth discrepancy was so huge that america didn’t expertise an uptick in soybean oil exports in 2022/23 regardless of a drought slashing soybean manufacturing in Argentina, the world’s largest soybean oil exporter. Owing to the drought, 2022/23 Argentina soybean oil manufacturing hit the bottom degree in additional than a decade, inflicting world importers to show to Brazil for soybean oil and different lower-cost alternate options equivalent to sunflowerseed oil and palm oil to offset the shortfall.

In early 2024, nonetheless, U.S. soybean oil premiums started to slender under the hole skilled through the previous few years. Soybean oil was the essential feedstock that allowed renewable diesel manufacturing to blow up so quickly and accounted for barely lower than half of biomass-based diesel feedstock utilization by quantity all through 2022. Over the previous yr, nonetheless, soybean oil share of feedstocks has slowly trended downward, dropping share to tallow and canola oil. With rising imports of decrease carbon-intensity feedstocks and lower-cost Canadian canola oil, reliance on soybean oil for biomass-based diesel manufacturing has declined, and home costs are responding. If worth premiums proceed to fall, U.S. soybean oil exports might get better barely. Forecasted 2024/25 U.S. soybean oil exports are up marginally however stay well-below historic volumes previous to the renewable diesel growth.

Greater Crush Helps Soybean Meal Export Beneficial properties

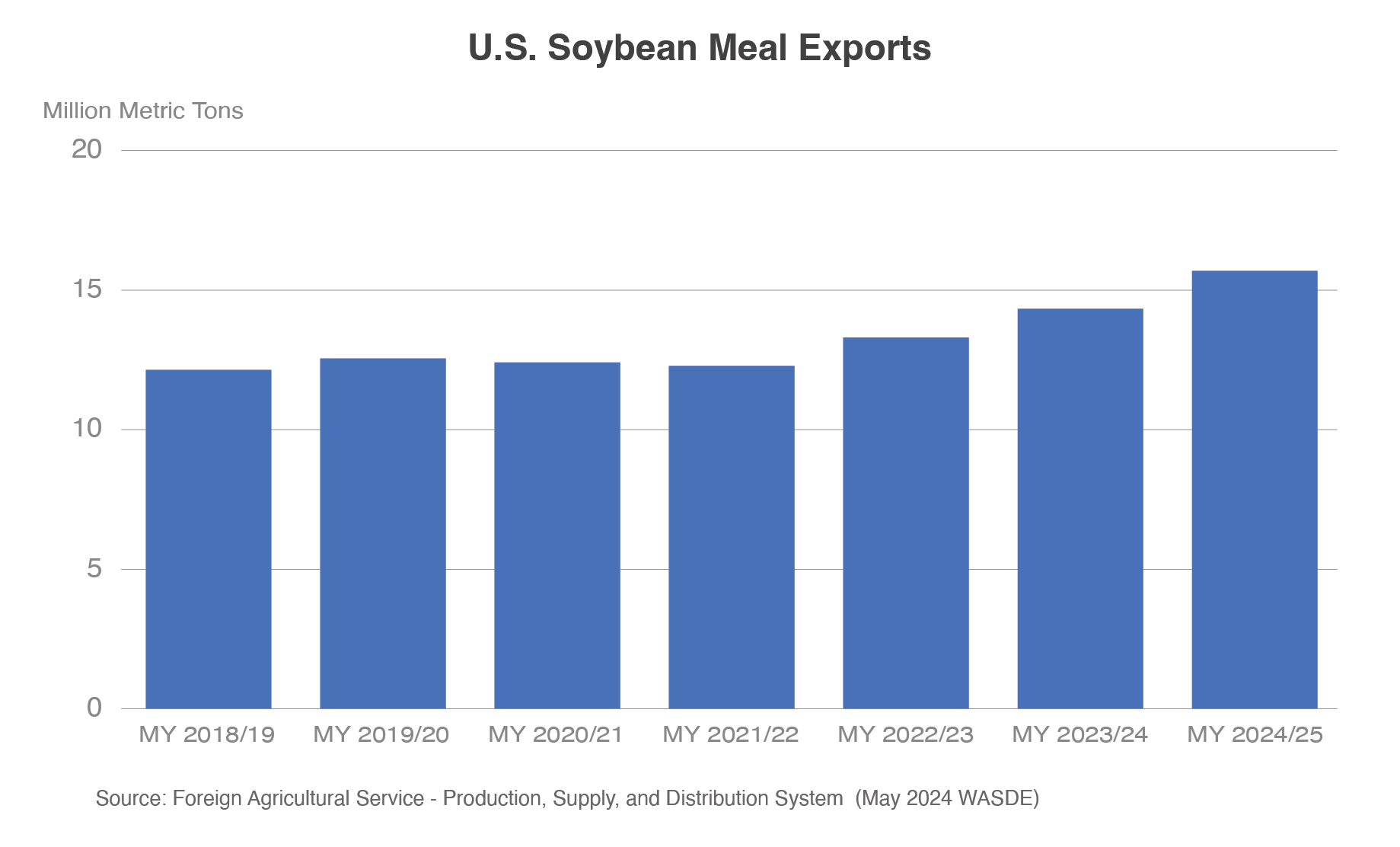

Strong development in U.S. demand for soybean oil pushed soybean crush increased, resulting in better soybean meal provides and document 2022/23 soybean meal exports. Higher provides and better exports are anticipated to proceed as 2024/25 U.S. soybean meal exports are forecast at a document for the third consecutive yr. Historically in america, soybean crush was pushed by the demand for protein-rich soybean meal for feed rations. Consequently, the next oil produced was a secondary product to be consumed for meals, used for biofuels and different industrial functions, or exported. Nonetheless, for the reason that renewable diesel growth, excessive soybean oil costs are driving U.S. crush, resulting in considerable soybean meal manufacturing. Since a typical soybean crush facility produces meal and oil in roughly a 4:1 ratio, the excess of meal can accumulate quickly as crush expands for oil. Moreover, soybean meal has a comparatively brief shelf-life, so provides have a restricted timeframe to be consumed, resulting in considerable exportable provides as soon as the native demand is glad.

Previous to the renewable diesel growth, america sometimes accounted for 18 p.c of world soybean meal exports behind Brazil (25 p.c) and Argentina (40 p.c). Nonetheless, america is anticipated to develop market share to 21 p.c in 2024/25 owing to development in exportable provides. Beginning in 2022/23, inspired by increased crush demand, U.S. soybean meal exports grew eight p.c. U.S. exports had been additionally supported by the historic drought in Argentina, leading to a 22-percent drop in manufacturing for the world’s largest soybean meal exporter. This each lowered competitors for U.S. exports and boosted world costs. Consequently, U.S. soybean meal export values in 2023 jumped 21 p.c from the earlier yr’s document. The impacts of the drought continued to assist U.S. soybean meal exports via the primary half of 2023/24, as Argentine crush didn’t get better to pre-drought ranges till March 2024.

The Way forward for U.S. Renewable Diesel and Commerce Implications

As U.S. soybean crush and renewable diesel manufacturing proceed to develop, the impacts described above ought to, for probably the most half, develop into extra exaggerated. Nonetheless, there are a number of wildcards that might each heighten or dampen these shifts.

The primary issue driving these modifications is coverage, particularly the California LCFS and the RFS. As beforehand talked about, the growth of renewable diesel wouldn’t have occurred and not using a coverage incentive. Subsequently, the mandates and incentives created by these insurance policies will decide the speed of manufacturing development within the coming years, which might find yourself being effectively under present and proposed capacities at refineries. Thus, biomass-based diesel manufacturing ought to proceed rising based mostly on present federal mandates, however each development and the speed of development will probably be extremely depending on future federal and state insurance policies. Likewise, each imports of animal fat and vegetable oils ought to additional develop, however feedstock availability might restrict renewable diesel growth and sluggish development well-below proposed capability growth.

Coupled with development in feedstock imports, U.S. soybean oil exports ought to proceed feeling downward strain as biomass-based diesel manufacturing soaks up home provides and retains costs much less aggressive than different suppliers and substitutable vegetable oils. Though, if provides of much less carbon-intense feedstocks like UCO and tallow are ample sufficient to gas manufacturing development, U.S. soybean oil worth premiums ought to proceed dissolving. U.S. soybean oil exports might expertise a slight restoration at extra aggressive costs, however biomass-based diesel manufacturing ought to preserve soybean oil exports well-below the historic common.

One other advanced ripple impact from increasing renewable diesel manufacturing would be the affect on U.S. soybean meal manufacturing, consumption, and commerce. Throughout the previous yr, a big a part of the expansion in exports was as a result of lowered competitors from Argentina after the drought. Nonetheless, when Argentina manufacturing recovers to regular ranges, there seemingly received’t be sufficient development in world consumption for each increasing U.S. exports and a restoration in Argentine provides.

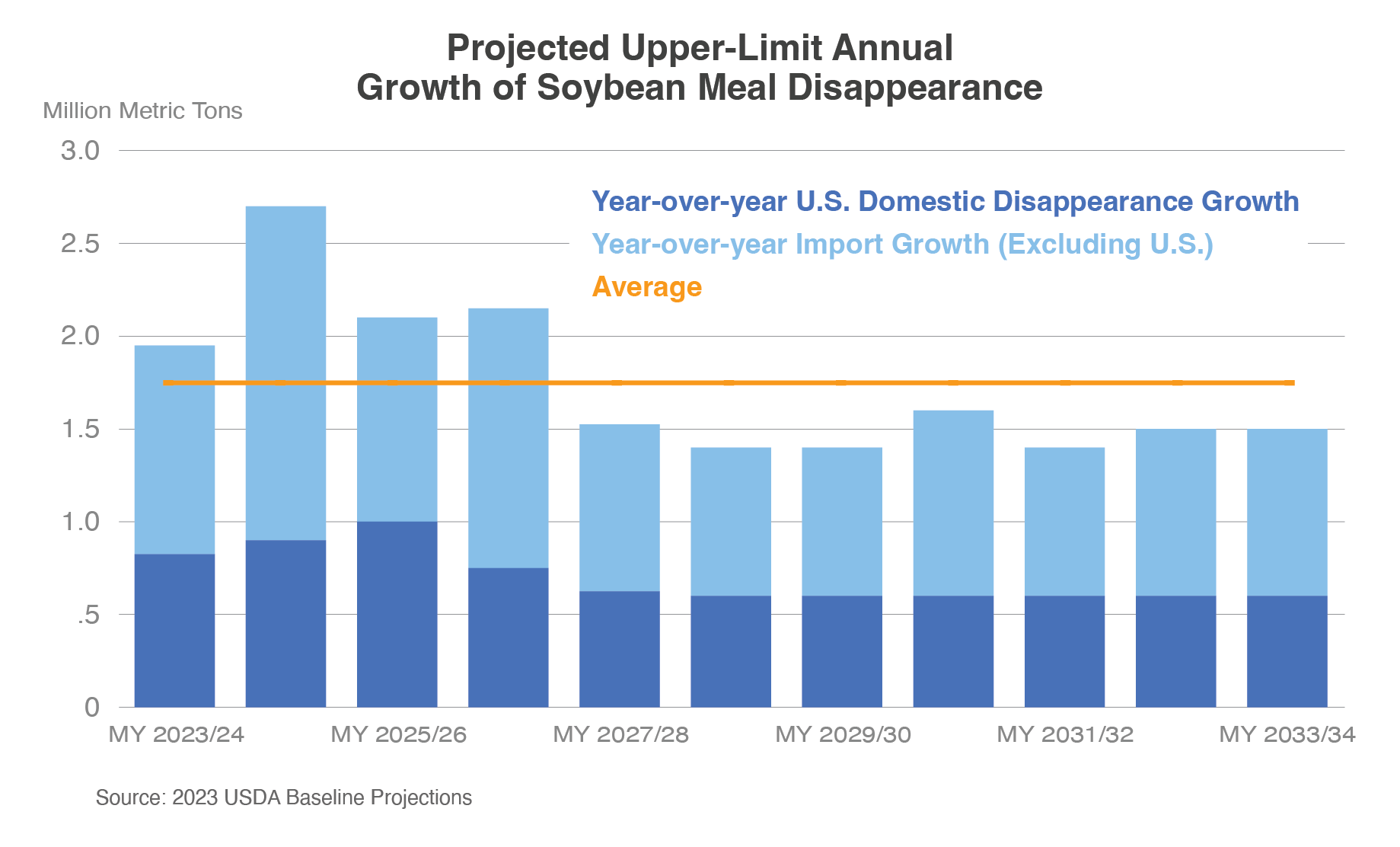

Even when america can seize all world soybean meal import development, U.S. crush and renewable diesel development might be restricted by the power to search out an outlet for surplus soybean meal. Based on the USDA 2023 baseline projections, U.S. soybean meal home disappearance is projected to develop by 0.7 million tons a yr on common through the subsequent decade. Likewise, world soybean meal imports are projected to develop by barely greater than 1.0 million tons every year. Assuming america captures all development in world imports, it might produce and distribute an extra 1.7 million tons of soybean meal every year, which might equate to about 0.4 million tons of extra soybean oil per yr. Development in soybean oil consumed for biomass-based diesel, nonetheless, outpaced this quantity in every of the previous two years, at 0.6 million tons in 2022 and 1.1 million in 2023. Primarily based on world demand for soybean meal, soybean oil can not proceed to gas renewable diesel manufacturing development at present charges through the subsequent few years with out main modifications to world soybean meal demand, shifts in exporter market shares, or decrease provides in different exporting nations.

If america overproduces soybean meal, U.S. corporations will export extra provides within the brief time period as a substitute of letting the product spoil in storage. With a purpose to develop export volumes, U.S. merchants might want to drop costs low sufficient to encourage price-sensitive patrons to change to U.S.-origin soybean meal. In the long term, nonetheless, if world soybean meal provides outpace world consumption and america shouldn’t be capable of take market share from Argentina and Brazil, each crush and probably renewable diesel manufacturing will probably be constrained by an incapability to get rid of soybean meal.

Sources

Gerveni, M., T. Hubbs and S. Irwin. “Overview of the Manufacturing Capability of U.S. Renewable Diesel Crops for 2023 and Past.” farmdoc day by day (13):57, Division of Agricultural and Client Economics, College of Illinois at Urbana-Champaign, March 29, 2023. Permalink.

Gerveni, M., T. Hubbs and S. Irwin. “Renewable Diesel Increase Archives, 16 articles.” FarmDoc Every day, Division of Agricultural and Client Economics, College of Illinois at Urbana-Champaign. 8 February 2023 – 17 January 2024. Internet Web page.

Kingsbury, Agata. “Biodiesel Insurance policies Suppress U.S. Soybean Oil Exports.” Oilseeds: World Markets and Commerce, October, 2023. Internet Web page.

Martin, Jeremy. “Every little thing You Needed to Know About Biodiesel and Renewable Diesel. Charts and Graphs Included.” The Equation, 10 January 2024. Internet Web page.

Bukowski, M., & Swearingen, B. (2023). Oil crops outlook: December 2023 (Report No. OCS-23l). U.S. Division of Agriculture, Financial Analysis Service.